#029 - PM Lessons by Meituan Co-Founder - Pt 23: Demand and Supply Factors: Space, Time

7 mins read - spatial and temporal changes in demand-supply; managing changes

👋 Hi! I’m Tao. As I learn about building products & startups, I collected some of the best content on these topics shared by successful Chinese entrepreneurs. I translate and share them in this newsletter. If you like more of this, please subscribe and help spread the word!

Factors Affecting Demand-Supply: Space

The demand-supply condition of an industry is affected by space.

Take the online dating market in China as an example. Overall, there is more supply of males than there is demand. (Note: The overall male-to-female ratio in China is about 105:100, but for younger age groups, it’s higher at 112 - 118. Population by Age and Sex 2018, Population by Sex, Marital Status and Region 2018, National Bureau of Statistics).

If we look at the segment of college students, at Tsinghua University, there is also a surplus of males, but at the country level, there are relatively more females in higher education. (Note: 51% of undergraduates, 50.9% of postgraduates, and 58% of vocational school students are female. Source: China National Program for Women’s Development 2011 - 2020, National Bureau of Statistics.)

In rural areas, the male-to-female ratio is even worse. Females usually have an easier time migrating to cities, therefore, in urban areas, and especially in big cities, there are more females in the reproductive age groups than there are males.

The gender ratio will affect a lot of things. If you’re making an online dating site targeting urbanites or one that targets the rural market, which side should you promote to? Which side is more likely to be paying members? The two options may have completely opposite answers.

Factors Affecting Demand-Supply: Time

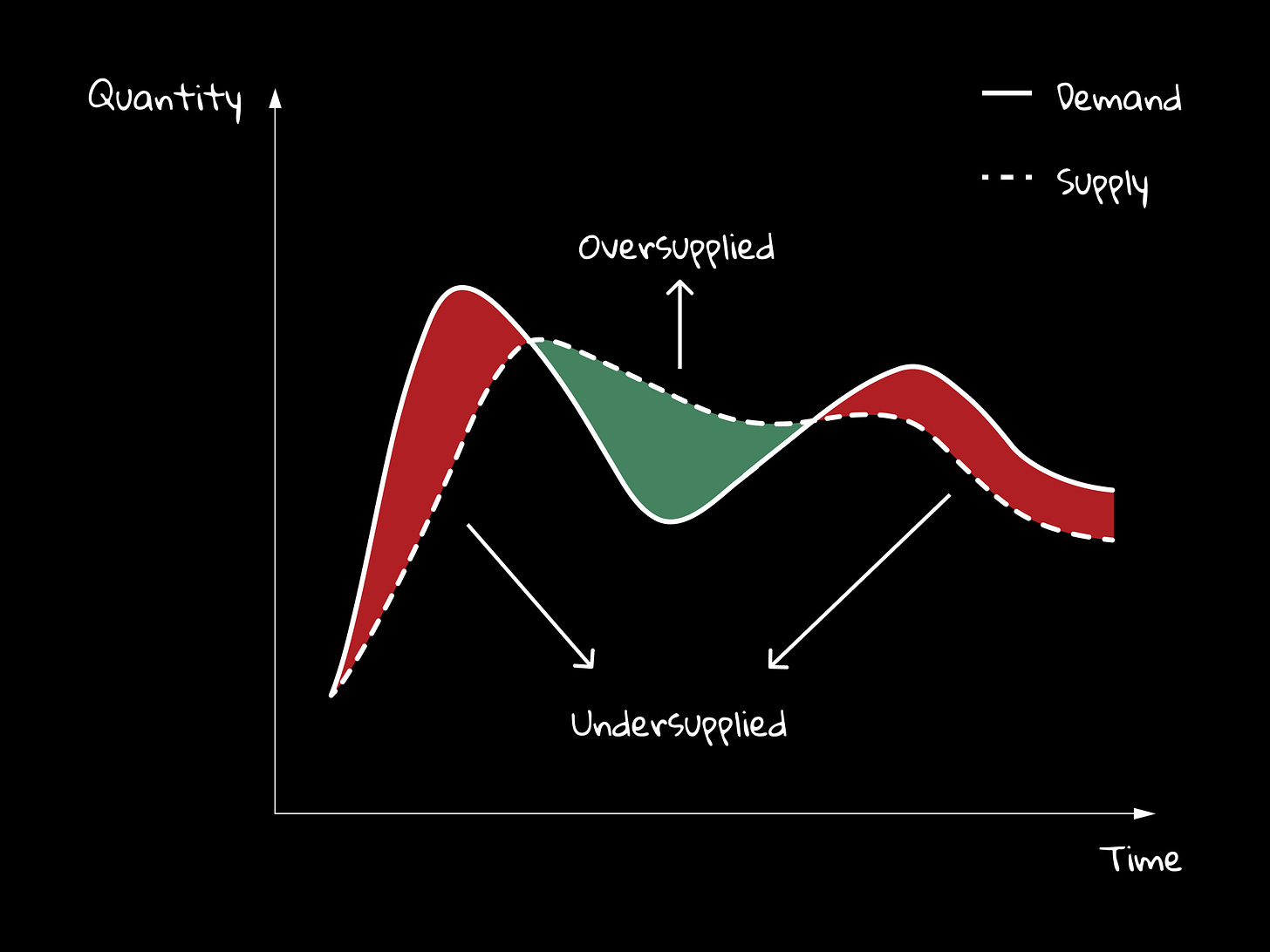

How frequently the demand-supply condition changes varies from industry to industry.

For example, in the ride-hailing industry, the demand-supply condition changes at a rapid pace. In a typical one-week cycle, it’s undersupplied during the [weekday] morning peaks, balanced at noons, oversupplied in the afternoons, and then undersupplied again in the evenings and nights.

(Related Reading: Understanding Supply & Demand in Ride-hailing Through the Lens of Data by Grab)

Some industries change very slowly according to time. At the macro level, the demand-supply condition of the retail industry is slow to change. It probably takes a whole lot of changes in human habitation, energy costs, transportation, etc. to bring about a significant change in the retail industry. In the past, that was about once every 30 years. Some changes are due to the changes in economic, political, and societal conditions (PEST). Some changes are due to the changes in industry practitioners’ cognition and operational competency. These changes speak to a general trend - as the retail industry continues to innovate, the gross margin declines.

Every 50 years or so, retailing undergoes this kind of disruption. A century and a half ago, the growth of big cities and the rise of railroad networks made possible the modern department store. Mass-produced automobiles came along 50 years later, and soon shopping malls lined with specialty retailers were dotting the newly forming suburbs and challenging the city-based department stores. The 1960s and 1970s saw the spread of discount chains—Walmart, Kmart, and the like—and, soon after, big-box “category killers” such as Circuit City and Home Depot, all of them undermining or transforming the old-style mall. Each wave of change doesn’t eliminate what came before it, but it reshapes the landscape and redefines consumer expectations, often beyond recognition. Retailers relying on earlier formats either adapt or die out as the new ones pull volume from their stores and make the remaining volume less profitable. - The Future of Shopping, Darrell Rigby for Harvard Business Review

Changing slowly could be a scary thing too. A 30-year-old young man may have enough business and life experience suited to be an entrepreneur in the retail industry. And when he’s 60 years old, he may have made something for himself. Just when he’s about to retire, the industry undergoes a transformation.

Walmart is probably the best offline retailer in the world in terms of revenue and market cap. But when they started, they were the underdog. They faced a powerful, much larger competition, Kmart.

People usually think the greatest advantage in the retail industry is cost leadership from Porter’s Three Strategies. An advantage in the cost structure leads to cheaper prices, and cheaper prices win over customers.

At that time, people thought cost leadership mostly come from bulk purchases to get better prices from suppliers. The greater your sales and order quantity, the stronger your bargaining power with suppliers, and the greater your competitiveness. As such, in the retail industry, the brand with more stores and more sales would be more competitive.

When Walmart just started competing with Kmart, Kmart already had thousands of stores while Walmart only had a few dozens. So for quite a long time (1962 - the 1970s), Walmart didn’t compete with Kmart directly - direct competition means opening a store within one of Kmart’s stores’ (say 5, 10 miles) radius.

Kmart’s founder Harry B. Cunningham retired in 1972. As he was stepping down, he told his team to watch out for Walmart, although they’re still small now, we need to keep an eye on them. After Cunningham retired, Walmart opened a store in Kmart’s territory and competed successfully, and the rest is history.

This is how it goes in the retail industry. A disruption happens only once a few decades. The disruption usually stems from the change in demand-supply conditions. The change might be slow, but it’s scary.

(Note: It doesn’t help that many retailers became the subjects of financial engineering by private equity and hedge funds and not actively managed by operators anymore.)

Organizational Implications

The pace at which the demand-supply condition changes has a meaningful impact on companies.

The food delivery business is similar to retail. Walmart has to operate store by store. Food delivery companies have to operate cluster by cluster (”Honeycomb”). The success of one store has little bearing on another store, other than the collectively larger scale which may bring some benefits.

Walmart’s slogan is “Every Day Low Price”. How are they able to do that?

Most people’s first response would be because Walmart has so many stores, they have economies of scale in the supply chain, so they can have lower costs. But that’s not true. The very first store that Walmart opened already achieved everyday low prices. The lower prices didn’t come from economies of scale. (Note: “Every Day Low Prices” as a strategy was adopted in 1974 when Walmart had 78 stores and Kmart probably had 1,000+ stores.)

Additionally, when your store carries a great variety of goods, your operation would become exponentially more complex. It’s the same in food delivery. When your area has more merchants, more consumers, and more delivery staff, your operation becomes more complex.

How to improve the operation? You’d need people dedicated to solving this problem.

At that time, Meituan didn’t have a team that does this kind of job, so I wondered if we can poach a team from another company. We first looked at Internet companies, but they didn’t have this kind of talent. Then I asked HR to look for people who work at the nexus in offline retail, but no luck either. Finally, I asked the offline retail bosses why they don’t have these kinds of jobs which are so important. And they told me when they have such a need, they just go to consulting companies like MBB. So I poached some consultants to form the business analytics team of Meituan.

I wondered, “why the retail companies which face complex operational and organizational problems don’t have dedicated business analysts on their teams?“ Following that thought, I looked at which other jobs they should have but don’t. And I discovered that most retailers don’t have a product R&D team either, but Walmart does.

After much deliberation, I think this is because their industry is too slow-changing. Business analytics and product R&D jobs won’t have enough to do in a slow-changing industry. These teams tend to be costly. In a slow-changing industry, the ROI of having such a team is very low, so low that it’s cheaper to hire consulting firms when the need arises.

Similarly, for their technological needs, most retailers won’t develop their own software or have a software engineering team. Their software probably comes from SAP.

As such their rate of iteration is very slow. When the industry undergoes a transformation, and the company doesn’t foster talents that respond to changes. The external people won’t be able to deeply understand the company’s operation and is slow to iterate. When the industry undergoes a change, and the external solution is not able to respond as fast as the change is taking place, the company will be disrupted. This is why it’s scary when the industry changes very slowly.

When you run a company, you will face the question of whether to develop a certain organizational competency within the firm or not. Be it a tech team, product team, business analytics, or else. These are important strategic decisions, and it depends on the characteristics of your industry.

This is one of the most important organizational implications of the change in demand-supply conditions in response to time. Some industries change rapidly while others are most slow-moving. One is not necessarily better than the other. The key is to understand what fast and slow mean.

We also need to consider whether the demand-supply conditions changes are on the macro or micro level. For example, the demand-supply condition in the retail industry is fast on the micro-level. The SKUs usually have a seasonality, so it’s measured in seasons, which is pretty fast and can be hard to manage. Retailers usually outsource the hard-to-manage SKUs and adopt a partnership model. For example, in a supermarket, for a category that changes every season, they may bring in a partner to have a store-within-a-store. (e.g. cosmetics)

Find the article insightful? Please subscribe to receive more learnings from Chinese Internet companies and I’d appreciate it if you can leave a comment or help spread the word!