#023 - The A/B sides of the Internet

15 mins read - PM Lessons by Meituan Co-Founder - Pt 18: Strategy for Operation - Categorizing

The A/B-sides of the Internet is the most mind-changing idea that I got from Wang Huiwen. As a product builder, I try not to read the news too much, because a) the actions by big companies have little relevance to what I’m doing. b) I can’t see the N-th order implications of an event like Bobby Axelrod. However, the A/B sides of the Internet idea here helps me to make sense of acquisitions, product decisions, and why a category is hotly contested, etc. Hope you find it inspiring!

This article is based on this lesson and a talk he did previously.

Design is categorizing

The product leader of WeChat, Allen Zhang, said that design is categorizing. To put things into their rightful place is exactly designing. In our daily life and work, we tend to look at things specifically - the task at hand, the industry, industry characteristics, product features. Rarely do we consider the big picture to look at the categorization of an industry, even though it's a very meaningful exercise.

If we were to categorize the entire Chinese Internet industry with just one cut, how should we do it?

There are many angles from which we look at the Internet industry. One of which is to divide by technological sophistication. We dichotomize technologies into A) "traditional" - those that have been entrenched in our lives and we take for granted, and B) new technologies such as AI and big data. Another angle is by what industry Internet integrates into, such as education, F&B, retail industries. (i.e. "EduTech", "FoodTech", "Retail Tech"). The angle that we choose result in meaningful differences.

The angle that I'm going to talk about is leaning towards categorizing by the “traditional” Internet characteristics.

A/B Sides

If we were to categorize with just one cut, we can divide these companies into two categories - one supplies and fulfills online and the other supplies and fulfills offline. Let's call them A-side and B-side. Notice the difference in their areas.

A-side Internet companies are video sites, live streaming, online games, etc. B-side companies are Alibaba, JD, etc. Most of Meituan-Dianping's businesses also belong to the B-side.

The area on top is relatively smaller because the area corresponds to the entire industry's GDP. For example, Alibaba and JD are in the retail industry. The retail sector is a very big contributor to China's GDP. (Note: The wholesale & retailer sector accounts for ~10% of China's GDP, while Information & Communication, Software, and IT Services accounts for 3%, and Culture, Sports & Entertainment accounts for 0.7%. 2016 data.)

There's another angle we can talk about here. Although the industry of video, live streaming, etc. is not as big as the retail industry, it receives a greater degree of influence from the Internet. Things like online games are “pure Internet”. But for retail or e-commerce like Taobao, since the fulfillment and delivery are conducted offline, the Internet has a less degree of influence on this industry.

This degree of influence will affect their gross margins. The area below is much bigger, but the companies at the B-side don't necessarily enjoy a high margin. Generally speaking, if you look at companies' financial reports, you can see the A-side companies usually have high gross margins, and B-side companies usually have low margins. These are some of the ideas that we can get from just one cut.

B1 and B2

If we were to cut one more time and only once more, we can build upon the previous basis.

This may be what it looks like: A-side remains unchanged, but we further divide the B-side into B1 and B2. B1 is SKU-based supplies. B2 is location-based services (LBS).

Why can these two be divided?

Their information architectures, product interaction processes, and business operations will be very different. But where do these differences mainly manifest?

For A-side, where supply and fulfillment are conducted online, the core competencies of the company lie in product design, understanding the users, and managing communication, socialisation and content. These capabilities are common in A-side companies.

For B1, the company's core competencies lie in understanding SKUs, understanding the supply chain, and understanding pricing. (Note: Genki Forest is actually a good example.)

For B2, if you were to inventory B2 companies, you'd notice a remarkable commonality among them - a large offline team. Having a large offline team is one of the biggest differences between B1 and B2 companies.

Differences Between B1 and B2

Scale Effects

In SKUs retailing, suppliers enjoy scale effects. Most of the suppliers for Taobao and JD have scaled production. However, in services, the suppliers such as delivery riders and Didi drivers don't enjoy scale effects. SKUs can be manufactured, but people have anti-scale effects. (Note: Wang Huiwen sees Network Effects as a subset of Scale Effects.)

When facing large order volumes, the merchants on Taobao benefit from diminishing marginal costs of production and fast inventory turnover.

Large order volumes for services will drive up the marginal costs. Additionally, there is a high requirement for timeliness for services, consumers can't save up their consumption to make it convenient for producers.

As such, this led to a fundamental change in business logic. The business logic for service providers is to peak shaving and valley filling.

Merchant Recruitment

The merchant recruitment is also different. Taobao recruits merchants nationally. As such, there are plenty of alternatives for a category (or SKU) and they don't have to spend too much effort on merchant recruitment. For Meituan, however, the merchant that we recruited in a city can only serve the consumers in that city. Therefore, we have to do "ground push" in every single place to recruit merchants, which requires the commensurate organizational capabilities.

As a result, Taobao recruits merchants in Hangzhou (purely online), whereas Meituan's merchant recruitment teams are all over the country.

Infrastructures

B1 and B2 also require different infrastructures. The infrastructure for Taobao is logistics and payments, whereas for location-based services (LBS) - food delivery, bike-sharing, ride-hailing, restaurant reviews, etc. - the core infrastructure is maps and location-tracking devices.

Consequently, the importance of the location-tracking feature in the app - how fast, how accurate, how precise the app measures user's location - is an defining attribute of B2. Taobao is a great product, but for Taobao, the user's location is not that important, so the app may not necessarily report location with speed or high accuracy and precision. This [feature prioritization] has to do with core competencies.

Looking at A, B1, B2 as a whole

Developmental Perspective

Chronologically, A-side is where the first Internet products - email clients, browsers, and web portals - appeared. They lean to the A-side judging by their attributes and came out first to make the Internet itself more useful and usable. B1 came after, like e-commerce websites. B2 companies came about around 2010. Based on the timeline, we can see the three waves.

Why B2 began to emerge since 2010?

One of the reasons is that location is very important. Location is comprised of two parts - the first is the user's location, and the second is the supplier's location. Whether it's the user's location or the supplier's location, we need to get the location fast and conveniently.

The prerequisite for that is the prevalence of smartphones. Without smartphones, getting the location of users or merchants would be extremely difficult. Therefore, location-based services came about together with the proliferation of smartphones. Smartphones opened up this space. Before smartphones, there were companies operating location-based services, but they had a hard time operating.

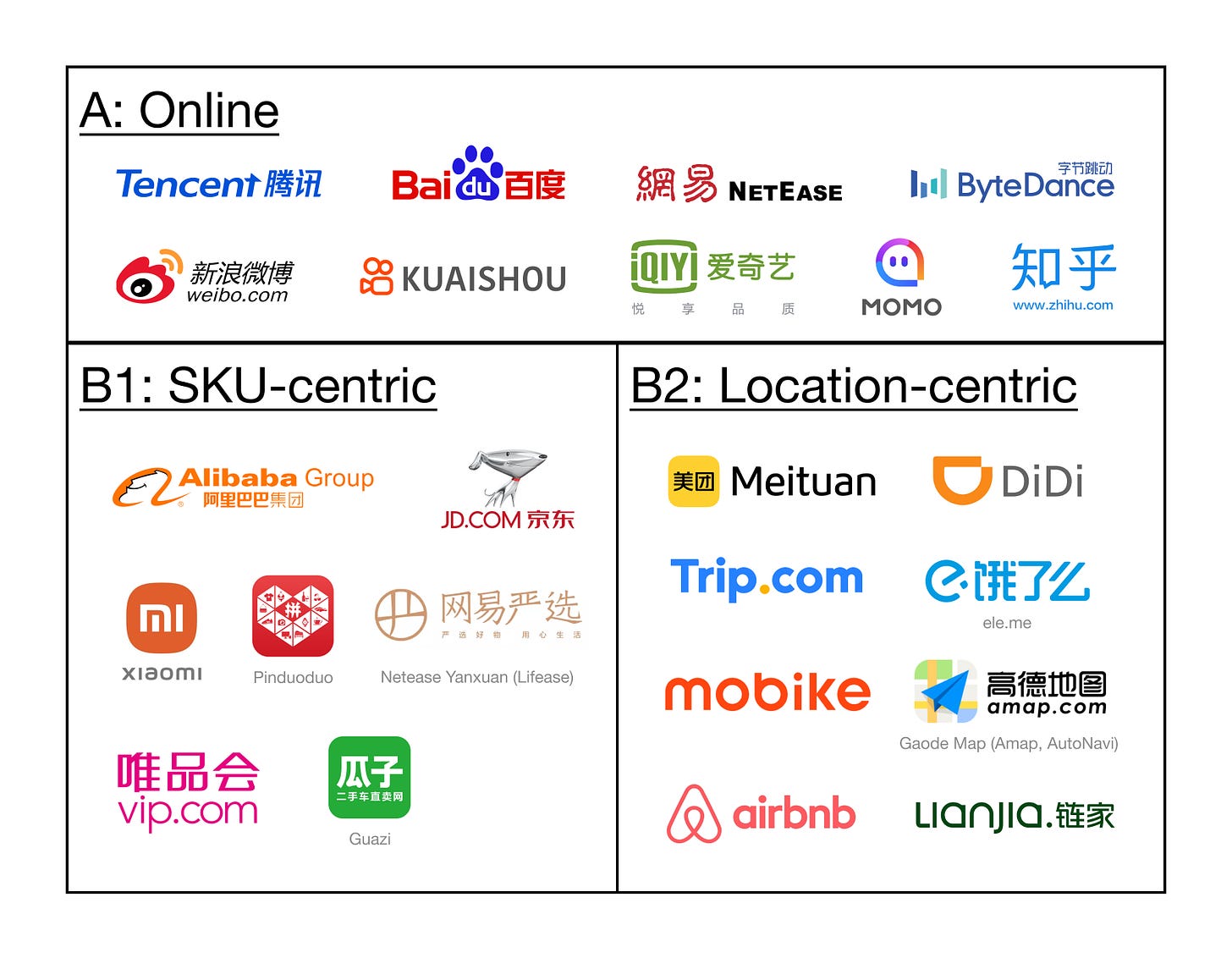

Typical Companies and Products

Let's take a look at the typical companies and products in the three categories. It'll look something like the below graph.

When we talk about a company, we often talk about the company's DNA or core competency. A company's DNA or core competency is determined by the category that it operates in.

We've talked about the different characteristics of A, B1, and B2. The different characteristics shape the corresponding companies' core competencies. They also to a certain degree shape the relationship between different companies as well as determining which industries a company can operate in or not.

From this graph, we can see a few things. Overall, every company here has a main coordinate, but we can also see some companies may be involved in another category. Generally speaking, the success rate of overstepping is not high.

For example, Tencent. As one of our investors, Tencent is our good friend. As an A-side company, they tried to enter into B1 with Yixun (B2C e-commerce). However, they realized that them operating in B1 was not going to be able to compete with Liu Qiangdong (founder and CEO of JD), so they sold Yixun to JD.

After that attempt, Tencent changed its attitude to solely focus on operating A-side businesses and participate in non-A-side businesses in the form of investments. Tencent invested in us Meituan, Didi, Ele.me, Lianjia and they couldn't get in Gaode Map (Amap, or AutoNavi). Of course, they also invested a lot in B1.

For Tencent, B1 and B2 require different competencies that it doesn't have, so they changed their strategy to investment.

Similarly for Alibaba, they want to be in the A-side. For example, Alibaba's Digital Media and Entertainment Group acquired Youku Tudou (video), Xiaomi (music) and also invested in films and television. Overall, the results are not too good, because A-side requires different core competencies than the B1 core competencies that Alibaba is familiar with.

In terms of the differences in core competencies, the distance between B1 and B2 is relatively closer, and the distance between B and A is relatively further.

Xiaomi

The more observant people may think that my chart is not accurate. For example, I put Xiaomi in B1. I did spend some time mulling over Xiaomi and I think it's accurate to put Xiaomi in B1.

Between B1 and B2, Xiaomi's core competencies and business characteristics are more evident in B1. B1 tests a company's understanding of the supply chain. Xiaomi really has a very deep understanding of the supply chain now. This categorization is by the different companies' main business.

Meituan’s Competition

On a related note, I want to mention something that's frequently brought up. People usually have doubts and opinions about Meituan Dianping. They think we have relatively more enemies and we often get into fights.

In fact, if you look at this graph, do you find some patterns?

From when we started in 2010 till now, we have many competitors, especially in 2015. In 2015, we have four businesses:

Group Buy - the competitors are Nuomi (acq. by Baidu) and Dianping (pre-merger)

Movie Tickets - Nuomi Movie (Baidu), Weying (Tencent), Tao Piao Piao (Alibaba)

Food Delivery - Ele.me (Alibaba), Kuobei Waimai (Alibaba)

OTA - Ctrip, Qunar

You may notice all our opponents are concentrated in B2. In fact, the B2 category is the most fought over battleground in China's Internet industry since 2012. The bike-sharing war, the ride-hailing war, and the food delivery war were all in B2.

Why is it so fiercely fought over?

Because the B2 category only just started in 2012, and new opportunities just emerged. Everyone has a similar level of cognition of the opportunities, a similar level of industry understanding, and similar core competencies. The scenarios that we see are also similar. The similarity in core competencies results in us clashing in scenarios, it's unavoidable. (Note: “Scenario” is a term I’ll cover more on.)

ByteDance

While we’re on the topic of competition, today, many think that ByteDance is a belligerent company. If you look at it closely, is any of ByteDance's oppponent in B1 or B2?

ByteDance works on information stream and short videos.

Who's its competitor for short videos? Kuaishou. ByteDance's Weitoutiao's (Note: "Mini Headlines", allows content creators on Toutiao to engage with fans.) competitor is Weibo. ByteDance's Q&A product, Wukong Wenda, is competing with Zhihu.

ByteDance mainly operates in A-side, although it still has many competitors, they concentrate the fights in A where they have core competencies.

The reason why ByteDance faces so much competition is that the categories that they operate in have also been undergoing rapid changes in the last few years. New opportunities emerged and hence the intense competition.

4 Scenarios of LBS (B2)

If we take each of the three categories as a whole, we may think A-side is what we call "pure Internet", B1 is what we used to refer to as e-commerce. If we were to cut B2 one more time, how would it look like?

Since it's location-based, there are the consumer's location and the supplier's location. Whether the location moves then becomes an important element. We can categorize B2 into these few scenarios:

The consumer doesn't move, the merchant/supplier moves. Delivery, on-demand services. Typical examples are Meituan Delivery, Ele.me, 58 Daojia (home services)

The consumer moves, the supplier doesn't move. These are in-store services. Example companies are Meituan Dianping, Lianjia (property), and we may also include Airbnb.

The consumer moves, the supplier moves. Ride-hailing, bike-sharing. Typical companies are Didi, Mobike, Uber, EvCard (car rental).

Cross-cities. Hotel booking, travel, transportation tickets. Typical companies are Trip, Meituan Travel.

There are some intricacies with the different scenarios. For example, hotel booking is mostly used cross-cities, but there is also a high percentage of same-city hotel bookings. As such, the in-store business and cross-cities business consume the same supply.

Herein lies the problem. The roots of Meituan Dianping is the group buy business, and one of the group buy categories is the inventory from hotels for in-store consumption. (e.g. discount hotel stay for staycation). But you can't prevent consumers to group buy hotel bookings in a different city. (i.e. you get the group buy discount rather than the OTA discount.). Cross-cities hotel hookings is Ctrip's (Trip.com) scenario. Naturally, Meituan and Ctrip would come into conflict.

This has nothing to do with the company's values or whether the company is belligerent, it's a natural conflict due to user scenarios.

Ctrip used to be a major shareholder in Yongche (ride-sharing). If Yongche had done a better job, Yongche would have been a competitor to Didi. Since it didn't, Yongche is not competing with Didi. (Note: Yongche pivoted to more niche use cases.). Ctrip and Qunar today also offer private car service and so they may still be competing with Didi.

One of the important scenarios for private car service is getting to and from airports, so Ctrip and Didi's businesses have some overlap. When two companies' main scenarios are similar or they share some overlap, inevitably, there will be some friction. If the two companies are belligerent, a fight is unavoidable.

China and US Markets

US Benchmark

These are the four main scenarios of LBS.

Let's look at it from another perspective. For A, the leader today is Tencent. Who's the US equivalent for Tencent? Facebook. Google is corresponding to Baidu.

As we can see today, Tencent and Facebook's market caps are basically equivalent.

China’s leader in B1 is Alibaba. Alibaba is corresponding to Amazon. And their market caps are roughly equivalent. (Note: before recent market changes and Ant.)

But for the leader in B2, who's the US benchmark? In Meituan's development, one of the biggest concerns from all the investors, especially the US investors, is that it's very hard to find a suitable benchmark company in the US.

Why LBS differs In China and the US

We spent time trying to understand this. In LBS, why is there such a big difference between Chinese and US companies? We think it's mainly these four factors:

Labour cost.

Large scale fulfillment team is needed for LBS. Our food delivery business on an average day roughly has about 500K people delivering. When we talked to our South Korean counterparts, they told us their biggest worry is that their monthly turnover of delivery riders is 30%. This is a societal infrastructure. China differs greatly from countries like the US.

Population density.

We can see the US cities have a much lower population density comparatively. Corresponding to the low population density is the low density of merchants. The low density in both greatly affects location-based services. Regardless whether a lower population density is desired, for delivery, the impact is definitely negative. It affects delivery time and the time to get the meal.

Population size.

Generational competition.

Looking at all the industries from a historical perspective, at different time periods or every once in a while, the industry would undergo an upgrading. For this upgrading, let's call it a generation. The US retail industry from when it started till now, it's probably at the 4th, 5th generation. If the mainstream retail format in the US market is 5th generation, and now there's Internet retail, which we‘d call the 6th generation, the generational competition is between the 6th gen and 5th gen companies.

Generational competition - Beating the Status Quo

What's the number 1 competitive element in an industry?

It's the status quo, not the competition between competitors. The US has a long commercial history, so many industries and businesses have developed very well over several generations. If we call the last generation companies as the conservatives, then the conservative forces in the US are very strong. In China, the conservative forces are very weak.

When I just started working on the food delivery business, I conducted some market research and found something that surprised me.

The largest delivery site in the US is called Grubhub, but they only had hundreds of thousands of orders a day. Domino's Pizza had more orders than it did! Big chains like McDonald's and KFC didn't want to work with Grubhub either because they can offer delivery themselves. The delivery service has become a standard in established F&B chains. Additionally, the Americans eat pretty much the same things every day, unlike the Chinese, we have a lot of varieties.

This led to the last-gen solution being rather satisfactory, leaving very little room the the next-gen solution.

From the research that I did at the time, there were only three companies in China focusing on food delivery. In total, their orders were less than 100K a day. There's no wide consumer awareness [of this product experience]. Their finances were not great either. If we see them as our last-gen, when we started, they were very weak.

What does this mean? It means when we started, we were not just bringing the Internet to the food delivery industry, we were building the food delivery industry itself. In fact, since we're building the food delivery industry itself, our impact to the industry is much greater than just digitalizing the industry, our commercial value would also be greater.

This is a core difference between China and the US. Considering all these factors, we can understand why American investors can't understand Meituan.

Lastly, a simple judgment - for the LBS category, China is a much better market than the US due to our population density, labour cost, population size and generational competition.

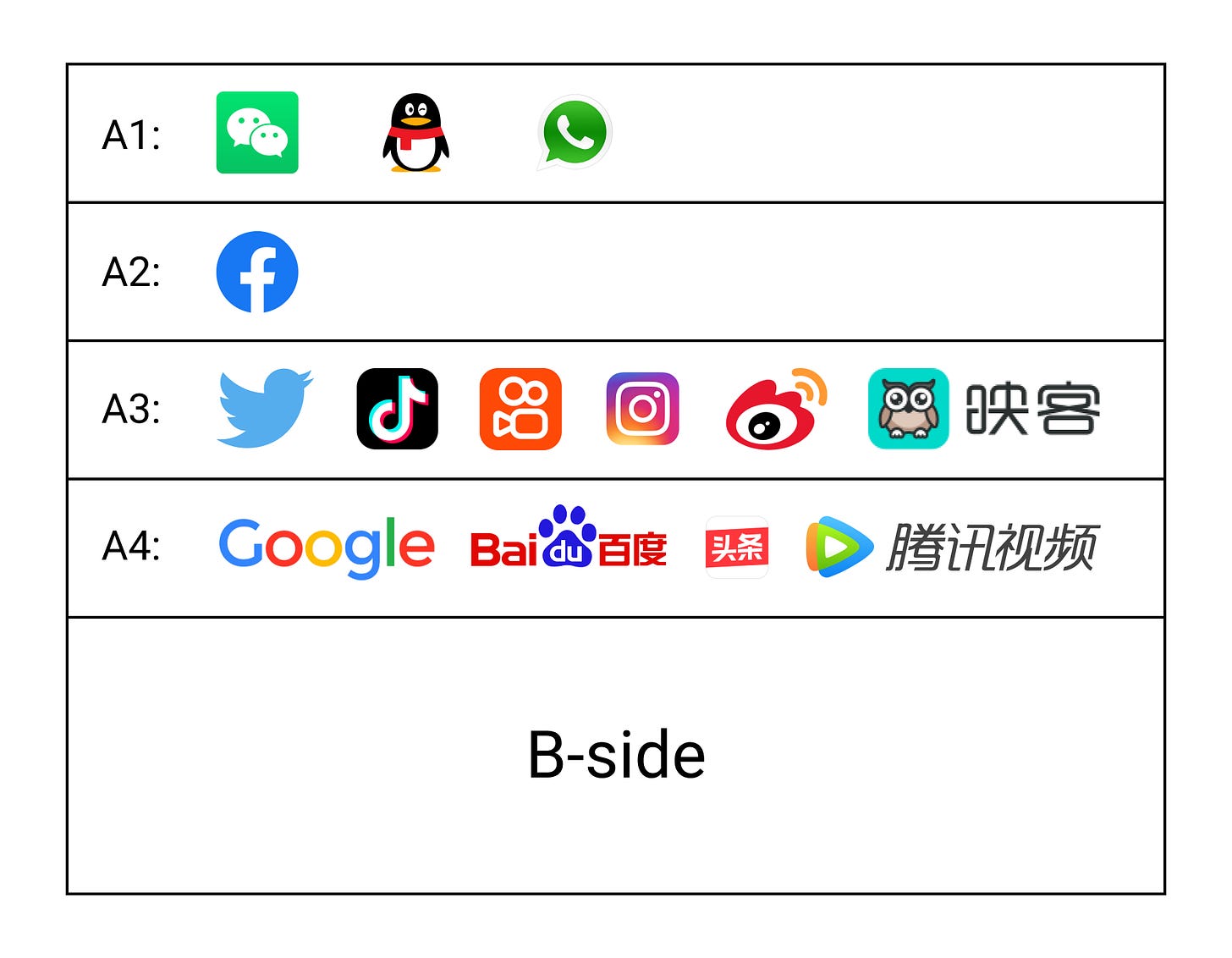

Categorizing the A-side

Previously, we’ve covered the categorization of the B-side. Now, let's talk about categorizing the A-side. If we cut the A-side once more, we can divide it into 4 categories by the visibility of information:

A1 - WeChat, WhatsApp, Line

A2 - Facebook

A3 - Twitter, Weibo, Tiktok, Kuaishou, Instagram

A4 - Toutiao, Google, Baidu, Tencent Videos

When sending messages in WeChat, only the recipient can see. (Note: In moments, comments from a friend's friend on a friend's post won't be visible to you unless you're also a friend with the friend's friend. In short, you won’t see a user’s activities in WeChat unless you’re a direct contact.)

In Facebook, other people can see your friends. (Note: Unlike WeChat, you can see your friend’s friend’s activities on Facebook.)

Sending a tweet in Twitter will be visible to everyone, but your followers will see it first.

In Google and Toutiao, all the information are visible to everyone.

If a product incorporates features that show information with different visibility, then it becomes very hard to segregate the users.

For exmaple, when Weibo first came out, some users would have private conversations on Weibo's public domain. If we incorporate WeChat and Weibo's features into one product, then users would get mixed up and it's fatal for user experience.

On categorizing by information visibility, Facebook is the winner. Their products - Facebook, WhatsApp, Instagram - are all separated and they occupy A1-A3, only leaving A4 to Google.

Similarly, despite the dominating success of WeChat, Weibo's survival is not affected, because the two has different information visibility. Weibo has 200M DAUs.

Heart vs. Data

The core product methodology differs for products with different information visibility. Allen Zhang's product philosophy is fundamentally different from ByteDance's product philosophy. Allen Zhang says you have to use heart to make products. At Bytedance, it's all about data - whichever product has the better metrics wins. As such, to date, Tencent still hasn't succeeded in information stream and short videos. Of course, ByteDance's Feishu (Lark) is not making any progress either.

This is due to the fundamental differences in product methodology. To oversimplify, the difference is, for A1 and A2, you mainly rely on heart, and for A3 and A4, you mainly rely on algorithm.

Tencent has long relied on human brains rather than machines, which resulted in them not being strong in machine learning algorithms, espcially after they sold their search business to Sogou. However, it's not that they don’t understand algorithms, it’s just their ability to apply algorithms is not that strong.

Superapps

Categorizing also has implications for which products can be made into one app and which can't.

Taobao and Alipay have huge traffic, but putting Ele.me there didn't do much.

WeChat and its Moments have such great traffic, but Weibo is still thriving.

It's also why Meituan is able to consolidate so many things into one app, because most of them are in B2.

Douyin and Toutiao are separate apps. They didn't incorporate Douyin into Toutiao despite Toutiao's huge traffic.

All these have to do with categorizing. Categorizing correctly involves core competencies, resource allocation, consumer psychology, and organisational abilities.

(Lastly, a graph to summarize everything.)

👋 Hi! I’m Tao. As I learn about building products & startups, I collected some of the best content on these topics shared by successful Chinese entrepreneurs. I translate and share them in this newsletter. If you like more of this, please subscribe and help spread the word!

Insightful. This puts me thinking about the long sought puzzle of "Why there are no super apps in India or USA?". Since most of the superapps contains other services from the same tier, i.e., A, B1 or B2. (Opinion - I think the most of superapps are built in B2 space)

And in India, the wave of B2 startups has just started and we're already seeing some inital signs of superapps like Swiggy (allowing users to order Food, Groceries, Genie, Household items, etc. Not to forget its strategic investment in Rapido which allows them for other potential integrations), NoBroker Hood (Super app for real estate) etc.

While for USA the high labour cost, low population density and the status quo doesn't give much space to B2 startups to thrive.