#021 - Genki Forest Case Study - Part 3

15 mins read - Speed is how the startups win; Private Domain Traffic; Finite to Infite Games

👋 Hi! I’m Tao. As I learn about building products & startups, I collected some of the best content on these topics shared by successful Chinese entrepreneurs. I translate and share them in this newsletter. If you like more of this, please subscribe and help spread the word!

This is the last part of the Genki Forest Case Study series. See part 1 and part 2.

If you want the original slide deck, share this newsletter on Twitter/Linkedin/Facebook or with your friends/colleagues via Slack, etc, and send a screenshot of the share to chinaplaybook@substack.com

05 Flat Channel Management

After analyzing product, let's look at channels. After all, there is no avoiding that Genki Forest would have to come face to face with the incumbents in offline sales.

Based on our understanding, Genki Forest has achieved a total sales volume of over ¥2.5B RMB (~US$390M) across all its channels in 2020, far exceeding its goal.

On breakdown by channel, the biggest chunk, ~40% is taken up by traditional channels such as F&B retailers and schools (varies by geography, here is an average estimate), followed by convenience stores (CVS) (35%) and e-commerce (25%). Key Accounts (KA) such as big supermarkets account for the remaining 1%.

We estimate, by 2020, Genki Forest has already set up over 700K sales endpoints over the country and has over 2,000 salespeople to interface with the distributors.

From our research, Genki Forest's offline sales model is not too different from those of other traditional companies.

Their key to achieving a breakthrough in channel is to leverage technology in order to implement flat management for higher organizational efficiency - quite characteristic of Internet companies.

As shared in his speech, the way for a small company landlocked by giants to break out and win is through efficiency.

He understands it as the Power Law: if a man has $3 billion dollars compounding at a rate of 1.1 per day, and another man has only $100K but compounding at a rate of 1.2. After some time, the second man will be richer.

The "Power" is more important than the base.

(Note: This sounds more like Compounding, but compounding is a power law.

In another example, he explained why it may be a good idea to double down on your winners, as he painfully learned.

Suppose you have a product scoring 100 is compounding at a rate of 1.2. Your ego or misjudgment tricks you into making another product since you think you’re so good at it and there’s another opportunity. Splitting your resources into two projects so you have 50 x 1.2 + 50 x 1.2, which is the same as before, 100 x 1.2. But you feel great because you made two successful products.

But you’re better off pouring all your resources into the first product (Happy Farm in his case), to focus on improving the power from 1.2 to 1.4.)

For big companies, they have almost unlimited resources. Habitually, they solve every problem through money.

The employees at these companies spend most of their time on "managing up" - how to make powerpoints for reporting, how to get budget, how to help the superior hit his KPI. Naturally, the "power" is greatly reduced.

On the other hand, the extreme lack of resources at small companies can keep the company running at top speed, thereby greatly improve the "power" and it becomes the key to success.

He has personally lived through it with Elex's YAC (Yet Another Cleaner) antivirus software beating a big company (Baidu) with a hundred times bigger budget.

We will cover some examples of how specifically Genki Forest increases the "power" in their management.

1. Digitalize Office Work

Starting from 2018, the entire Genki Forest company has gone paperless - anywhere from manufacturing to approval, reporting, etc.

They first used DingTalk and developed tools and processes based on Alibaba's infrastructure. Using DingTalk as the backend, the front-line salespeople could use the "Store Canvassing System" to keep track of sales and profit targets. Through the smartphone, the company could also see how operations people have been hitting the ground as well as receiving daily and weekly reports.

Later, Genki Forest switched over to ByteDance's Feishu (Lark) as the office automation system.

In addition, Genki Forest also developed their own store canvassing app, with functionalities such as listing out the outlets, route planning, issuing receipts, data dashboard, etc., to allow front-line personnel to plan and optimize their canvassing.

All these sound great but how do they actually impact efficiency?

Let's look at an area of operation in detail. From a sales rep to a regional director, there are five layers between them. If the person in charge of any of the layers takes more than an hour to approve, there will be a monetary penalty. As such, the approval process and issue handling can be done extremely fast. To apply for a new campaign, you can get the necessary approval within 3 hours, whereas in a traditional company, it'd take 3-5 days.

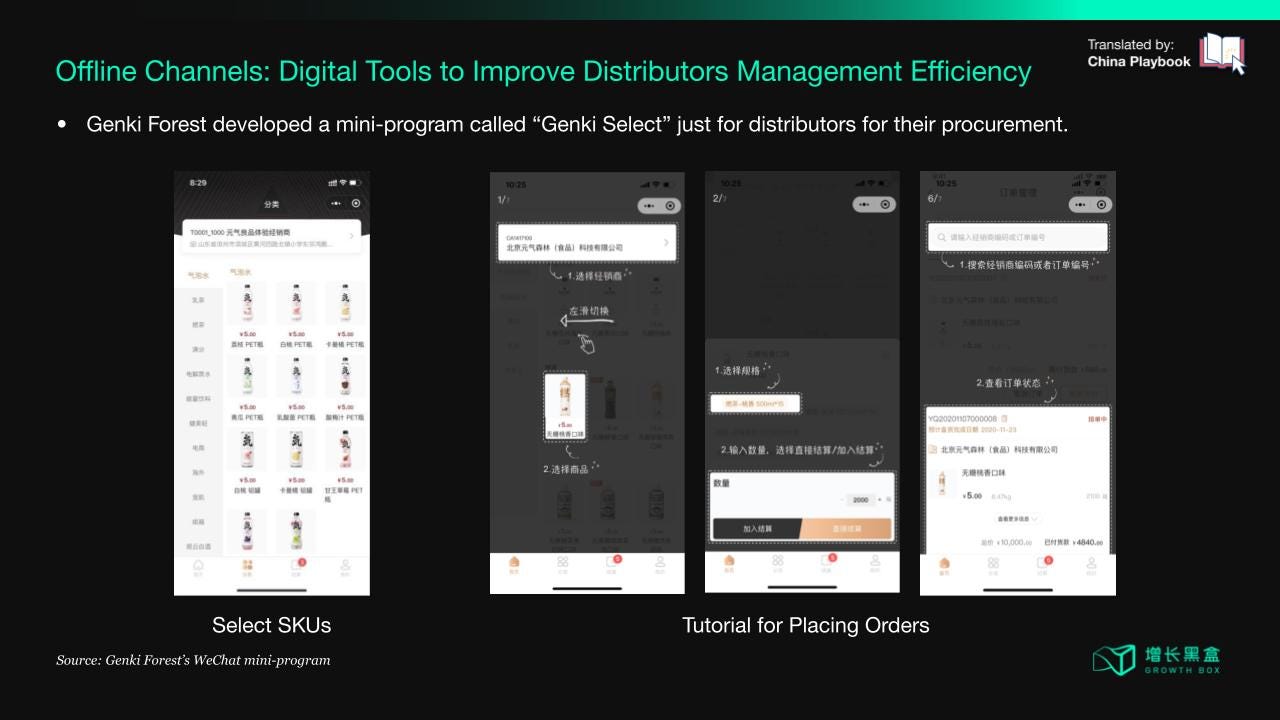

Aside from within the company, Genki Forest also uses digitalization to improve the management of distributors.

The following image shows the one-button order app for retailers, "Genki Select" 元气良品. The product prices vary for different retailers.

2. OKR (Objectives, Key Results)

Genki Forest has introduced OKR to the company relatively early, in place of the traditional KPIs. The benefit of OKR is to let employees have clearer goals and to boost their self-motivation.

To illustrate, a regional manager could set the Objective to be XXX million sales revenue, and the Key Results would be the number of endpoints, number of cities, number of shelve listings, number of fridge placements, etc. Two other common Objectives are a) team building and training and b) improving operational quality.

The setting of objectives trickles down from a national level to individuals. Eventually, these objectives are enforced through performance reviews.

More could be said but we'll stop here.

3. Amoeba Management

Those familiar with management studies may have heard of it. Created by Kazuo Inamori in the 1960s, the system divides the company into small units called "amoebas", each responsible for its own management and profitability.

In this system, every employee plays a major role and voluntarily participates in managing the unit, achieving what is known as "Management by All."

For the sales team at Genki Forest, that's exactly how they operate. Every region is divided into smaller teams. Each team is in charge of its own operating profits. 10-15% will be distributed among team members while the remaining belongs to the company.

This allows maximum flexibility for the salespeople. To a certain degree, it also helps Genki Forest with budgeting and output management.

For a traditional company, the whole year's marketing budget has been decided last year. Regional sales directors would have to apply for budgets from the headquarter and go through multiple layers of approval. That leaves very little room for adjustment.

The Amoeba system is still a rather innovative approach considering how beverage companies have been running traditionally. For example, Nongfu Spring implemented its first Amoeba project in 2019.

4. Offline Data Feedback

For traditional FMCG companies, one of the main reasons for their lack of "flatness" is that the wholesales-retailers are not willing to provide offline data [if they have it in the first place]. As a result, the company's headquarter would have a long delay to get the latest data from the front lines. That's a problem that Genki Forest is trying to tackle as well.

We found that Genki Forest employed a data provider called "WinWin". (Note: 码上赢 - "Win on code" - I guess QR code or bar code.)

"WinWin" integrates with the POS machines at retail stores to directly collect transaction receipts data. In turn, WinWin provides accurate sales data to Genki Forest.

In 2020, Tang's Challenjers Capital even invested in WinWin in their Series A+ round.

A frequently used metric by Genki Forest is the "Coke Index", to quantifiably evaluate the sales levels.

Why an index?

If you solely look at the absolute sales figures of your products, you would be easily affected by confounding factors such as seasonality. As such, you need a stable reference point to judge whether a new SKU is doing well.

From industry figures, the classic 500ml Coca-Cola Coke has an 80% placement rate in all sales endpoints all over China, and its sales are relatively stable across the four seasons.

Defining one week as a sales cycle, through comparing the "Coke Index", Genki Forest can continuously monitor which SKUs are selling well and need to double down, as well as which are not and need to be taken off the shelf.

The speed at which this kind of insight is generated is several times faster than the traditional methods.

An example of how this is applied is the "Alienergy" energy drink. The product was first tested in selected convenience stores. The data quickly reported that it's not selling well and it's immediately being taken off the shelves. Now they're testing with "Alien" electrolyte water.

Of course, the retailers being unwilling to provide data is not so easily solved.

In its 2020 Distributor Conference, Genki Forest announced its plan to install 80,000 smart vending machines so they can monitor endpoint sales data in real-time. Comparing to Coca-Cola's 870K and Nongfu Spring's 360K, it's a much smaller number but it's a start.

In the following section, we'll explain the two characteristics that we discovered about Genki Forest's strategy on channels: heavy on convenience stores, heavy on e-commerce.

People who have worked in the beverage industry know that it's basically impossible to make money from placing in convenience stores because of the high commission. Logistics, fridge usage, marketing fees ... taken together, the commission could be as high as 30-40%.

Genki Forest still decided to place their products in Bianlifeng and 7-11. We think it's because they are eyeing the growth potential of convenience stores, and the overlap between the target audiences of convenience stores and Genki Forest.

As shown in the following chart, convenience stores are the second-fastest growth channel, only behind e-commerce. In 2020, the convenience stores market size in China has reached ¥250B RMB.

On the other hand, using 7-11's data to illustrate, the customer profile of convenience stores are mainly young people aged 20-29, and the largest two customer groups are white-collar workers and students.

However, due to high the barrier to entry to get on convenience stores' shelves, it has been a process.

Before 2020, Genki Forest outsourced the work to distributors. Genki Forest supply the goods, the distributors would negotiation with local convenience stores. It was quite efficient.

However, as there is a middleman involved, the channel fees were never transparent, and Genki Forest risks the drop in operation quality and the convenience stores going out of business.

Hence, starting from 2020, Genki Forest started to self-operate by working with large convenience store chains.

As for Genki Forest's e-commerce channel:

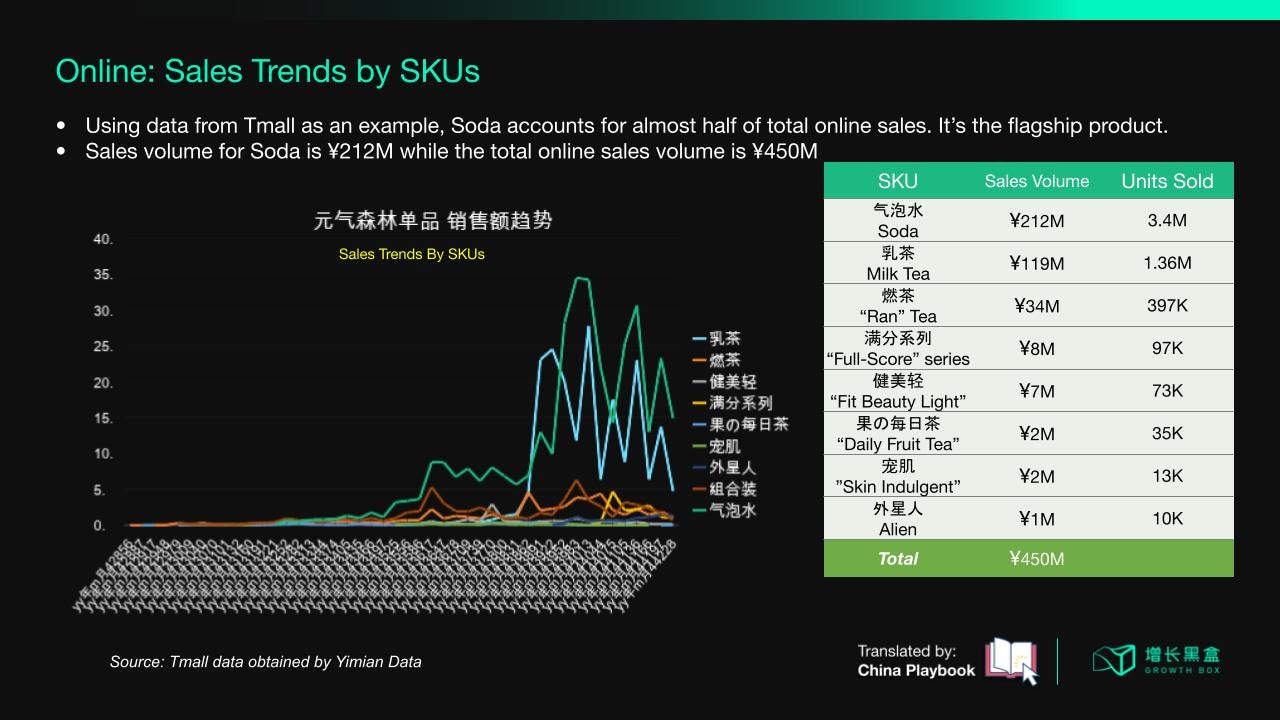

Data shows, the proportion of Genki Forest's online sales is much higher than that of traditional companies. For example, Nongfu Spring's e-commerce sales only account for 5% of the total sales. In 2018, Genki Forest's online sales account for more than 30% of the total sales. Tmall and JD are the main sales channels. As can be observed, 2020 is the break-out year for Genki Forest. Just its Tmall sales volume quadrupled and totaling ¥450M RMB.

Based on our analysis, we think it's due to significantly increased marketing spend.

From the e-commerce platforms’ data, we can also know that Genki Forest's sales are driven by hits. The Soda alone accounts for almost half of its total sales.

On the other hand, other than the Milk Tea released in 2020, the other products are lackluster in comparison.

We originally thought as since e-commerce is a self-operated channel, it should have a higher gross margin. Unlike offline channels, it could be a profitable channel. In the end, we found that although marketing campaigns are done by the company itself, the supply of goods is still through distributors.

That is to say, Genki Forest itself is still earning the small spread from distributors, no different from offline channels.

Plus, the retail price online should be lower than offline. With the advertising, live streaming discounts, the gross margins online could even be lower than offline.

We speculate that Genki Forest is prioritizing expanding the scale of the channels while keeping an eye on operating costs.

06 Building a DTC channel with Private Domain Traffic

Admittedly, Genki Forest is more than just the marketing hype. But undoubtedly, the omnichannel marketing capabilities are key to Genki Forest's success.

Based on our estimation, Genki Forest spent over ¥600M RMB on marketing online and offline. As a percentage of revenue, it's significantly higher than other beverage players.

Many other upstart FMCG brands adopted a strategy of "encircling cities from rural areas" (a Maoist war strategy) to break through the blockade by incumbents. For example, Feihe (an infant milk formula company) started from 3rd and 4th tier cities and slowly built up the premium brand before eventually conquering the 1st and 2nd tier cities.

Genki Forest did the opposite - encircling rural areas from cities, and concentrated its marketing on the Gen Zs.

This "attacking from high ground" strategy is a lesson that Tang learned from his gaming days.

In a 2015 interview, Tang attributed the success of Clash of Kings to this strategy:

"We dare to spend ¥1.8B RMB of our ¥2B revenue on ad placements, in global cities such New York, London, and Moscow to increase the brand awareness. Occupying the higher ground than go lower rather than the other way around is why Clash of Kings has become the most successful Chinese game in the international markets."

In 2020, Genki Forest sponsored 6 variety shows and a TV drama on satellite TVs and media channels such as Mango TV and Hunan TV, which focus on the female audience. At the end of 2020, Genki Forest paid ¥150M RMB for the sponsorship slot on Bilibili's 2021 Spring Festival Gala and gained 1.5 million followers on its new Bilibili channel.

Genki Forest's marketing strategy has already been widely covered so we won't repeat it here. That said, we’d like to expand on a recent focus of Genki Forest - Private Domain Traffic.

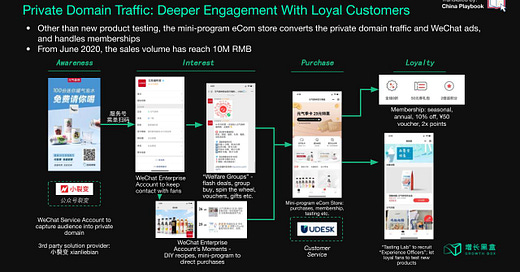

Genki Forest started laying the groundwork for its private domain traffic in 2020 - establishing an e-commerce store with the WeChat mini-program, setting up a WeChat service account, and using WeCom (WeChat for Work) to keep contact with fans - all on top of the WeChat groups it has already been running.

From the data that we gathered, Genki Forest already has over 200K followers on its WeChat private domains (WeCom + Service Account) and the mini-program e-commerce store has raked in close to ¥10M RMB in sales in the last 5 months.

These may not contribute much to the company's top line. However, this DTC channel is an excellent place to gather customer feedback and test new product ideas. For Genki Forest who would like to be as close to customers as possible, the DTC has great strategic value.

Next, we will break down how Genki Forest's private domain traffic operation works using the industry-standard "Traffic - Incubation - Conversion" framework.

First, on traffic, the primary method for generating traffic is through ad placements in WeChat's "Moments" (friends' feed). Intrigued users are led to Genki Forest's landing page and directed to follow its Service Account (where content, e-commerce, membership are conducted). The attraction is usually new product releases or heavy discount promotions. Users who want to get the discount vouchers must add Genki Forest's customer service to contact on WeCom, thereby becoming part of the "private domain", then go to the mini-program to place orders.

From our experience, the customer acquisition cost (CAC) with this kind of operation is ¥10+ RMB per follower. With that, we estimate that Genki Forest has already spent several million RMB on generating private domain traffic.

The second part is "incubation", where there is a much higher degree of freedom on how to go about it.

For Genki Forest, they:

Group message 2-3 times/day a batch of product information in WeChat groups, mostly about discount deals.

Direct Message 1 - 2 times/week new promotions through WeChat Business.

On the mini-program, organize "Experience Officer" campaigns and invite users to participate in new product testing. The experience officers would publish their reviews and they form a content community.

Last but not least, the conversion.

We think the key metric here for Genki Forest is not the GMV from the private domain, but how much useful user data they gathered.

The private domain team probably doesn't have a hard sales KPI.

Unlike other e-commerce channels such as Tmall, Genki Forest lists a lot more SKUs on their mini-program marketplace - aside from Genki Forest's own products, they even listed oral care products and gift boxes from other brands.

In addition, Genki Forest is also selling annual membership priced at ¥98 RMB a year. The main feature of the membership is to save money. From the data, about 10K people paid for the membership, so there are quite a lot of loyal fans out there.

To conclude, in order to let you guys have an easier time synthesizing all these, we put up a process chart for Genki Forest's private domain operations - from getting new visitors to converting them to place orders and eventually become members.

07 From Finite to Infinite Games

Let's recap:

Genki Forest, through innovating on three fronts - product R&D, channel management, and marketing & promotions - brought the high-efficiency Internet operating mentality to the FMCG industry, thereby accelerating the rate of trial and error and laying the foundation for making "hits".

Arbitrage Mindset: "Geographical Arbitrage" - bring mature concepts to China; "Neuro Connection Arbitrage" - Japanese-theme brand positioning to be associated with high quality in consumers' minds.

Rapid Testing: Borrowing the A/B testing methodology from the Internet industry; Creatively collecting online and offline data. Data tell which products could become hits.

Customer-centric Subsidization: Consumer demand as the highest priority. De-prioritize pursuit for gross margins. Focus on improving the product quality (taste), rather than maximizing scale and profits.

Flat Management: Digitalization & Office Automation. Use the Internet companies' management philosophies to improve organizational efficiency.

Build Up Private Domain Traffic: "High Ground" brand positioning and marketing; use DTC channels to keep close to customers, and to accelerate demand discovery and product testing.

While all these sound logical, the cost of innovation is to take risks.

No matter how much Genki Forest respects consumers' demand, it can't keep losing money forever. Eventually, they have to turn a profit, and to do that, they have to:

Control manufacturing costs

Raise prices paid by distributors.

In the past, Genki Forest has been relying on outsourcing factories and naturally, the production costs would be high.

On the other hand, this model has also resulted in production cycles and the mismatch between production and sales - excess inventories during off-seasons and out of stock during peak seasons. Selling last year's September stock during March this year was a frequent occurrence. Happening too often, distributors would have a lot of complaints. The usual solution to that is to send an extra batch of stock during the distributor's pickup, which would result in Genki Forest charging a lower than expected price to the distributor.

As such, Genki Forest decided that it's time to build its own factories.

Phase 1 of the first factory in Chuzhou has an annual production capacity of 30M bottles and a total production value of ¥850M RMB. It can manufacture "Ran” Tea, Soda, Milk Tea, functional drinks, and other beverages. Chuzhou phase 2 and a new factory in Zhaoqing, Guangzhou have already started construction in August 2020.

A new factory in the Northern-China region has also begun preparation. With the new factories, leveraging on the data team's optimization efforts, we believe the manufacturing costs will go down significantly.

The other problem with Genki Forest is its reliance on hit SKUs.

From the 2020 data, Soda Sparkling Water accounts for 60% of sales, and Ran Tea 30%, while Milk Tea and all the rest make up the remaining 10%.

Within Soda, the peach flavor as well as a few other SKUs account for the lion's share. By estimation, the entire soda market won't be bigger than ¥10-20B RMB. Relying on a few popular SKUs to hit its ¥7.5B RMB sales target in 2021 may prove to be a challenge.

As such, Genki Forest needs to accelerate its pace to discover new hit products, and broaden the product mix.

Nevertheless, Genki Forest never wanted to be walking on one leg. In Tang's own words, he wants Genki Forest to become "China's Coca-Cola", or even an FMCG empire. Therefore, expanding the product lines is something always on his mind.

Inside the company, Genki Forest is divided into several departments, including beverages, functional drinks, dairy, etc. Genki Forest has also been making plays with its subsidiaries - starting in 2018, Genki Forest began selling yogurt through the child brand, Beihai Ranch.

Externally, through investments by Challenjers Capital or Genki Forest itself, Genki Forest put even more horses on the tracks.

For example, we found that Guanyun Baijiu's controlling share (51%) lies with Genki Forest, and Genki Forest has started working on some liquor-exclusive sales channels inside the company.

What does the future hold for Genki Forest? Can they turn the finite game into an infinite game in the FMCG industry?

Let's witness!