#019 - Genki Forest Case Study - Part 1

The game developer who decided to sell drinks; Geographic Arbitrage, Neuro Connection Arbitrage

👋 Hi! I’m Tao. As I learn about building products & startups, I collected some of the best content on these topics shared by successful Chinese entrepreneurs. I translate and share them in this newsletter. If you like more of this, please subscribe and help spread the word!

One of the more interesting things about the China tech scene is startups are everywhere - not just in software. As Wang Huiwen covered a lot about marketing and product strategy in the last section, I think this in-depth case study on Genki Forest helps to deepen our appreciation. It’s a long article and took a lot of work (nothing compared to what the Growth Box team has done), so I’ll split it into 3 issues because of the email length limit and people’s attention span.

I’ve also obtained the original slide deck from the Growth Box team and translated it. If you want a copy of it, share this newsletter on Twitter/Linkedin/Facebook or with your friends/colleagues via Slack, etc, and send a screenshot of the share to chinaplaybook@substack.com

Founded in 2016, the beverage startup Genki Forest has become a national sensation with the "0 Sugar, 0 Fat, 0 Calories" slogan on its bottles.

In just 4 years, its valuation soared from $0 to ~US$2B. (Note: now valued at US$6B with its latest funding in March 2021 led by Sequoia China.)

In this article, the Growth Box team comb through the remarkable achievements that Genki Forest has accomplished in the past 4 years, and share the learnings of our research & analysis.

Foreword

In our conversations with beverage industry experts, we've noticed some interesting observations:

The beverage incumbent brands are perplexed by the rise of Genki Forest - with their dominating grasp on channel distribution and extreme cost control, how did they let a small startup with a gaming background slip through?

Based on what Genki Forest's operators shared with us, Genki Forest is still a small company but with big ambitions - they've set their sights to become the next Coca-Cola. At the same time, they are dissatisfied with many of Coca-Cola's practices and they want to advance a different set of values.

These are some interesting questions that set us on a two months journey digging into hundreds of industry reports, consulting industry experts, analyzing millions of sales data points, and even going undercover in their community groups.

We discovered some counterintuitive characteristics about Genki Forest:

Almost all of Genki Forest's products are the result of combining old elements in a new way. Each SKU can trace back to an original inspiration.

Even as a new consumer brand, Genki Forest is not afraid to set a high price point, and is willing to pay for more expensive ingredients. The average cost of a Genki Forest soda is 1RMB, much higher than what traditional incumbents pay for their products. The sugar substitute, erythritol, chiefly accounts for the higher cost.

Genki Forest's SKU development speed and R&D scale are several times higher than its competitors. But they only released 5% of their SKUs to market.

The beverage industry is inherently B2B. The other brands usually only have 5% of their channels being self-operated, but Genki Forest has 22%.

Genki Forest starts to invest in other brands in other categories as soon as their main products get on track.

To explain these characteristics, we will structure our discussion into 6 areas:

How did a game developer successfully crossover to make drinks?

The "Arbitrage Mindset" behind the consistent hit-making

Data-driven new product testing

A consumer-centric subsidizing model

"Flat" channel management

Building a DTC channel with Private Domain Traffic

We will quote some of Genki Forest's founder's thinking around product and business building. These are objective references to provide context, and we won't comment on them. Pick what you think is relevant.

01 The Game Developer Who Decided To Sell Drinks

Before Genki Forest, Tang Binsen has already made a name for himself in the Internet and gaming industry.

(Note: In 2008, his game "Happy Farm" was operating in 20+ countries, with 500M+ registered users. The game studio company, Elex Tech, was sold for ¥270M RMB in 2014.

In 2010, he took investments a ¥30M RMB investment from Kai-Fu Lee's Innovation Works to start the game publisher (among other things), XingCloud to help Chinese companies to expand and localize overseas.

In 2012, he took inspiration from Qihoo 360's free antivirus software model and started a web portal and antivirus software company serving the overseas markets.

In 2015, ELEX's self-developed game "Clash of Kings" became a hit, reaching No.6 on North American top-grossing charts. It set a revenue record for a Chinese-developed game in international markets and it's selected to be Facebook's 2015 Game of the Year.

Source: Baidu)

Despite that, Tang Binsen had zero domain knowledge and connection in the drinks industry. How did he create a beverage brand from scratch with zero prior experience?

Through learning, of course. Prior to founding Genki Forest, Tang Binsen had already researched into the consumer retail industry and even had some operating experience with soft drinks. He came prepared.

In 2014, after selling his gaming company, Tang started a VC, Challenjers Capital, which to date, has a cumulative asset under management of ¥8B RMB.

Looking through Challenjers’ portfolio in detail, we can find that other than supporting his former employees to venture out in gaming, Tang's another focus is in the consumer retail space. Challenjers is an early investor in Ramen Talk 拉面说, Panda Brew 熊猫精酿, as well as many liquor and drinks brands such as the new drinkers' favorite, Guanyun Baijiu 观云白酒.

Every successful investment in a company necessitates in-depth research into the industry as well as comparing hundreds of competitor and comparable companies. After the investment, the investor also has the privilege to be deeply involved in the company's operations. This is an excellent way to learn and accumulate experience.

Following this thread, we found something even more surprising - Tang had already invested in a company very similar to Genki Forest as early as 2015.

In Challenjers’ portfolio lists the beverage company UG Food 优选固本. (Note: not there anymore as when I accessed the site.) From the two companies' descriptions, they are almost identical - the operating model, and the "born after 90-95s" target audience.

UG Food’s Company Description:

Youxuan Guben (Beijing) Food Co., Ltd. was founded in 2015 and is a comprehensive fast-moving consumer goods company integrating research, production, supply, operation, and sales. Since 2015, the company has developed and created the first brand-new concept beverage product - "plus a bit" (nutrient fruit-flavored beverage). The core product consumer group is positioned at the young generation born after 90-95 who are young and vigorous and have strong self-expression.

Genki Forest’s Company Description:

Genki Forest was founded on 1 June 2016. It is an innovative beverage company with a complete industry chain, integrating research, design, procurement, production, logistics, sales/e-commerce, and services.

UG Food's flagship product is "plus a bit" 加一点 is built on the idea of "say no to sugar, say no to high calories, and say no to added fat", which highly coincides with the "Zero Sugar, Zero Calories, Zero Fat" selling proposition of Genki Forest.

If the previous two pieces of evidence may still be coincidental, then the following finding is the smoking gun.

UG Food's cap table lists Tang Binsen's wife, Xu Xiao, as a shareholder with 6% of the company's shares.

This is an unprecedented case in Challenjers’ records. As when UG Food started to fade out from the market, Genki Forest was born.

All these are to say, Tang was very serious about plunging into the beverage industry and he actually understands the industry.

Of course, aside from experience, another major requirement is capital.

Unlike other fast-moving consumer goods, the beverage industry has a very high market concentration. A few household names each cordoned off their own territories. For example:

The carbonated drinks category is duo-polized by two international brands - Coca-Cola and Pepsi, with respective market shares of 59.5% and 32.7%.

In the tea category, Master Kong 康师傅 and Uni-President 统一 have 60% of market share between them.

To build a new well-known brand would require a significant sum of marketing spend.

In addition, the beverage industry is essentially a B2B business and there is a heavy reliance on the wholesaler-retailer distribution model.

With the instant, compulsive consumption nature, the vast majority of drinks are purchased offline. E-commerce only accounts for 4% of beverage purchases.

Therefore, it's necessary to open your purse string to pay for the channel fees to make sure your drinks end up on the shelves and other retail endpoints. For convenience stores like FamilyMart, the slotting fees can be punishing.

As for recruiting talents, building distribution channels, and establishing a sales system, well, you can't skimp on those either. Indeed, in the early days, Genki Forest poached many top talents from the beverage giants.

Tang Binsen already had an illustrious career in tech, so capital was not an issue.

13 years before founding Genki Forest, Tang founded the gaming company, Elex Tech, after graduating from Beihang University with a master's in degree computer science in 2008.

With Xiaonei's support, his first game "Happy Farm" took over the country by storm. Shortly after, he brought the game to Facebook and it became an international hit.

Following this first pot of gold, Elex subsequently developed web portals, antivirus software, and another hit game, Clash of Kings.

After selling the company in 2014 for ¥2.6B RMB, Tang had already achieved financial freedom before he turned 32.

Although all the necessary conditions lined up perfectly, as to why Mr. Tang decided to make drinks, it's anyone's guess.

Here is the word on the street. When he was making games, he saw how his fellow game developers toil during crunch time, and they had to drink strong drinks like cola and Red Bull to pull them through. At the same time, these people have a strong demand for sugar-free drinks.

An idea formed in his head and he decided to "switch career" to make better drinks. As soon as the idea was clear, he started recruiting a team to help him do that.

02 The "Arbitrage Mindset" Behind Consistent Hit-Making

For every industry expert that we've consulted, we ask this one question: What is the core driving force behind Genki Forest's hyper-growth?

And their answers are surprisingly similar: they make great products.

So the conclusion of our research may disappoint you - Genki Forest doesn't have a "one-trick" strategy to consistently make hits.

In the beverage industry, the making of a hit is complex combinatorics of marketing, channel distribution, pricing, timing, and many other factors.

There is no fixed "hit formula". Whether you're an MNC incumbent or a new upstart brand, the only way to make something people love is through constant testing. Fair, at least in this regard.

As for Genki Forest, what they did was to drastically accelerate the "testing" process through relentless optimization and innovation, thereby increasing the probability of creating a "hit".

From the conception of a new product idea to market validation and feedback, and to making investments to improve product quality, Genki Forest imbued the Internet mentality into everything they do.

Let's analyze from the start - the conception of new product ideas. We think the core product strategy of Genki Forest is Geographical Arbitrage.

"The world is not and will never be so-called 'flat'. For successful businessmen, the competition is who can first extract profits from the information asymmetries."

Alexander Tamas, the founder of Vy Capital and a former partner at the Russian investment firm, DST Global, was the one who came up with this theory.

(Note: He may not have said these exact words. It's frequently quoted in Chinese tech media, and these are my translation.)

(Note: A 2010 Economist article (paywalled) which the origin of the "Geographical Arbitrage" theory traces back to. With the benefit of hindsight, we can see how it all played out. The fact it's from 11 years ago and I think most people still don't know/appreciate it highlights the point on information asymmetry and arbitrage. You're doing yourself a favor by reading this newsletter. 😉)

In the past decade-plus, DST has been utilizing and refining the strategy to perfection. Their first overseas investment was Facebook. Then they shifted their focus to less mature markets like China and invested heavily in JD.com, Alibaba, Xiaomi, and many more. (Note: ByteDance too). They also discovered unicorns in Russia and Brazil.

(Related Readings: 1. DST's non-census and right investment in Facebook in detail. 2. Alexander Tamas)

Interestingly, DST was an investor in Happy Farm's overseas rival, Zynga.

In an interview in 2015, Tang Binsen declared his love for the Geographical Arbitrage theory - "If a product can achieve great success in one market, it means it has potential to be promoted in other markets. People's usual concerns with cultural and habitual differences are hardly the decisive impediments."

Recall Tang's early Internet experiences, we can't help but notice whether it's web portals, free antivirus software, or mobile games, it's all about bringing the traffic models proven in China to less Internet-developed markets.

For a long time, half of Elex's revenue come from countries like Russia and Brazil. In these countries, for every 10 Internet users, one of them is using Elex's products.

Evidently, the same playbook that Tang used 13 years ago, is being used again today.

For example, one of the earliest investments made by Challenjers was Tiger Brokers. It basically copied the U.S. company, eToro's successful model to China. Now, Tiger Brokers is a public company (NASDAQ: TIGR).

Back to Genki Forest, the arbitrage opportunity is to copy mature, popular consumer concepts from more developed markets to China.

Based on reports, the logic behind DST's investment decisions is to look at the GDP and Internet penetration to evaluate whether a mature Internet business model can be replicated to the country, and what would be growth potential be.

If we were to superimpose this logic to the consumer goods category, the market size of the beverage industry determines the profit potential while the penetration rate of a product concept determines the growth potential.

In categories such as sugarless tea and sugarless carbonated drinks, Japan and other countries are clearly way ahead of China.

By CICC's estimation, in 2019, the penetration rate of sugar-free drinks is over 80% in Japan.

No doubt, the highly developed Japanese consumer market offers plenty of arbitrage opportunities.

Before Genki Forest's sugar-free tea product - Ran Tea (燃茶 "Burning Tea") came to market in China, Japanese consumers were already familiar with Suntory's sugar-free oolong tea, and Ito En's sugar-free green tea.

Genki Forest's Milk Tea may have also drawn inspiration from Ito En's milk tea and Fujiya's marketing.

The key factor at play here is either:

Many foreign big brands' products were never promoted in China despite doing well in their home markets.

Or they've been introduced to the Chinese market but just never caught on.

As the legendary American adman, James Webb Young, put, "An idea is nothing more or less than a new combination of old elements".

Of course, to create a unique brand, merely transporting ideas is not enough. That's why we postulate the second arbitrage - one based on brand positioning: the "Faux-Japanese" style is intentional.

In 2017, Luo Zhenyu (Dedao - "I get it" app founder, show host) invited Tang Binsen for an internal sharing. In the sharing, Tang recommended the book, Positioning, and put forth his "Neuro Connections" theory: arbitrage through human minds.

He gave an example - when "Japan" is mentioned, our brains' neuro networks make the association with "quality", as well as Japanese brands such as "Muji" that are known for good quality.

The brand positioning of Miniso is to intentionally create an association with Muji. (Note: The Chinese names look/sound even more similar.) Subconsciously, as you associate "Miniso" with "Muji", you associate "Miniso" with "quality".

There are two requirements here:

Find an empty space in consumers' minds and form a connection there.

That empty space must have value.

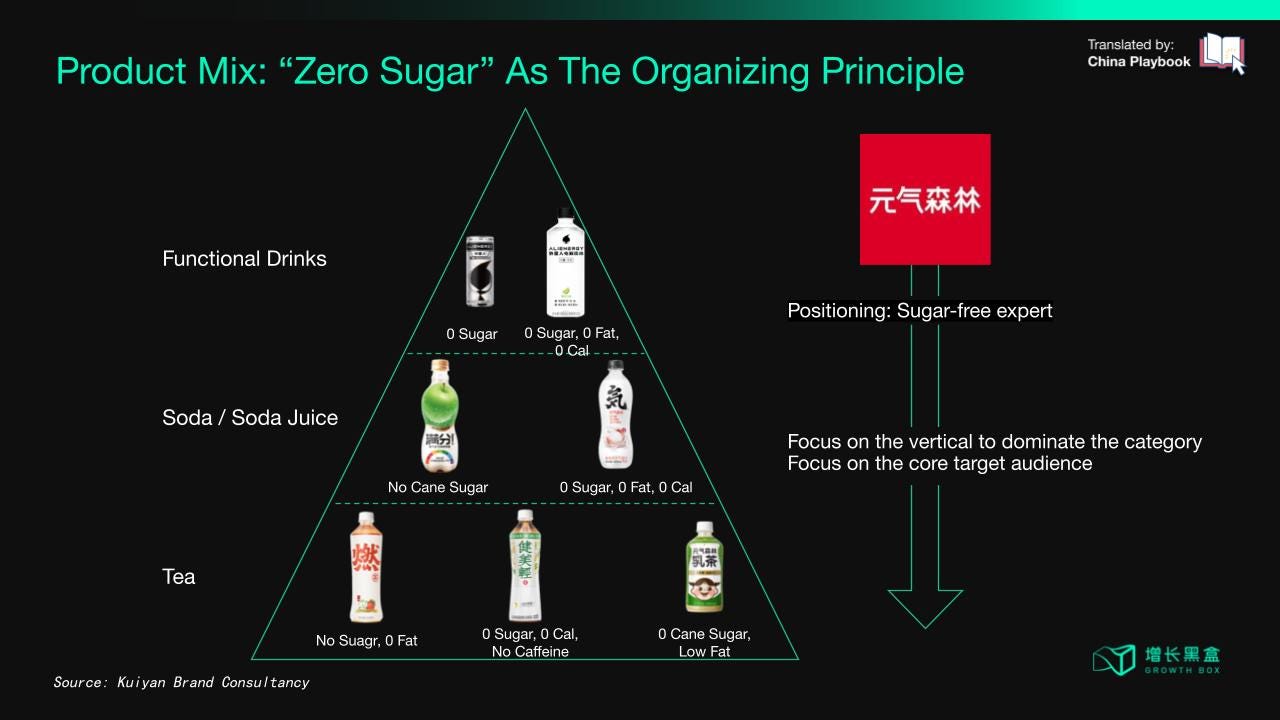

Evidently, all of Genki Forest's products to date center around "zero-sugar", "sugar-free" or "no cane sugar".

Under this "sugar-free expert" brand positioning, the tonalities of all its products are highly congruent with the positioning. The consistency also helps Genki Forest to focus on the sugar-free drinks category and the health-conscious core target audience.

Looking at the market from that vintage, it's both empty and valuable.

Find the article insightful? Please subscribe to receive more learnings from Chinese Internet companies and I’d appreciate it if you can leave a comment or help spread the word!