👋 Hi! I’m Tao. As I learn about building products & startups, I collected some of the best content on these topics shared by successful Chinese entrepreneurs. I translate and share them in this newsletter. If you like more of this, please subscribe and help spread the word!

Let’s get you up to speed:

Wang Huiwen is the co-founder of Meituan, who recently retired at age 42 with an estimated net worth of >US$2B. He opened a Product Management course at Tsinghua University in September 2020. This article and others in this PM series are my translation and edits based on a compilation of the content of his course shared online. You can see other articles in this series here.

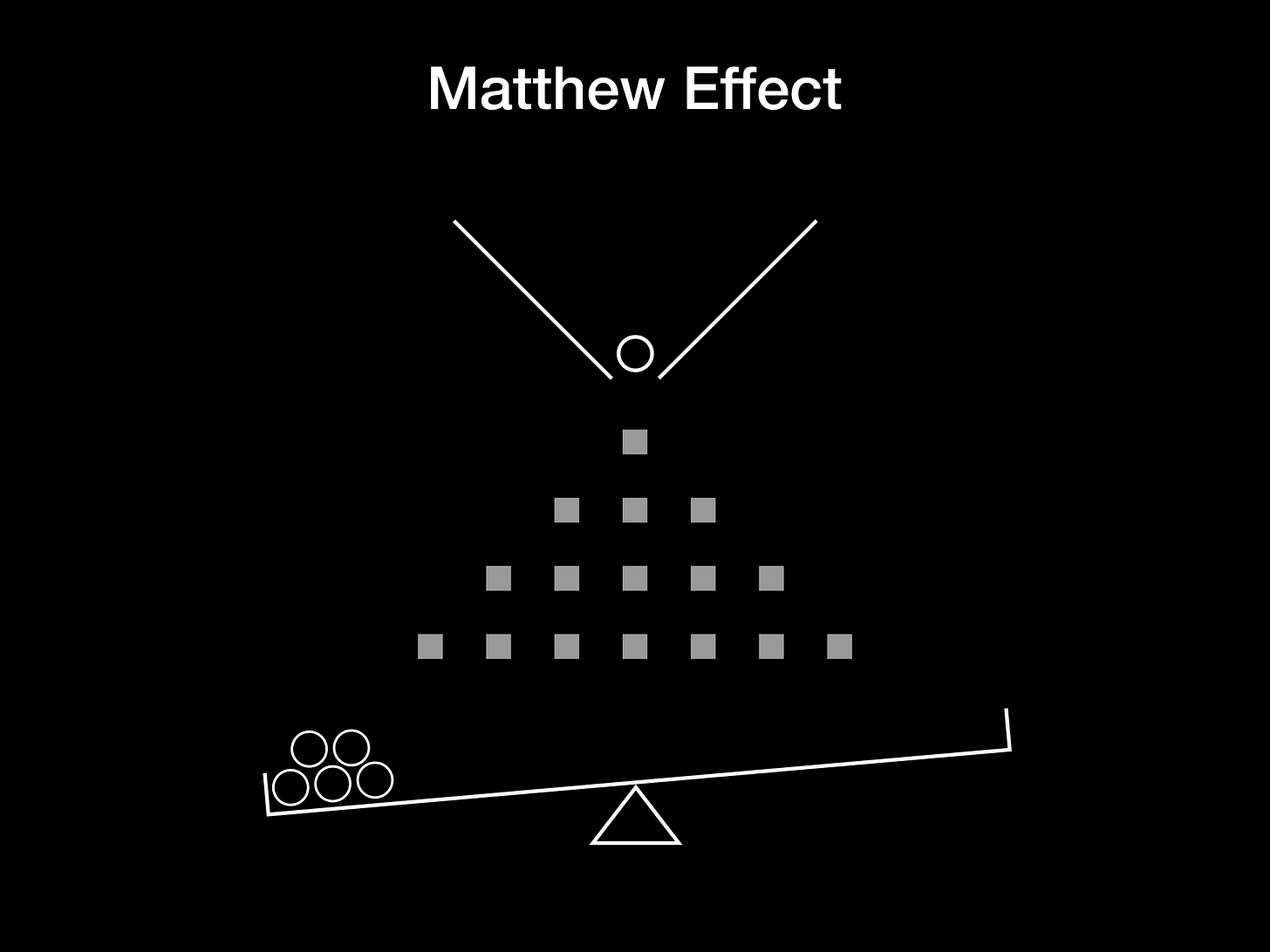

Matthew Effect, coined by sociologist Robert Merton, derived its name from the parable of the talents in the biblical Gospel of Matthew, "For unto every one that hath shall be given, and he shall have abundance: but from him that hath not shall be taken away even that which he hath." ("The rich get richer and the poor get poorer“). Originally to describe the phenomenon in science where eminent scientists will often get more credit than a comparatively unknown researcher, even if their work is similar, the Matthew Effect has also been recognized in education, politics, economics, and other fields.

Matthew Effect is directionally similar to Network Effects and Scale Effects, but there are important differences. I think of Matthew Effect as the Theory of Evolution in the business world. It accelerates the survival of the fittest in society. The reason I think why Matthew Effect exists is because in most fields most of the time, we can't make good judgments. As a result, we can only follow the judgment of people who seem to be right or to follow the consensus. These people who seem to be right will reap the benefits of others trusting and following their judgment.

People attach emotions (mostly negative ones) to Matthew Effect. Growing up with modest means, I’ve always detested the existence of such a thing, so I couldn’t accept the validity of the theory. But I have come to realize that a law is a law, and we can’t pretend it doesn’t exist just because we don’t like it. We need to recognize the laws, understand how they work and who do they affect, and make them work for us. Let’s look at how Matthew Effect works in the business world.

In Business

An industry where Matthew Effect is becoming evident is venture capital. Specifically, the deal flow, returns, and LP contributions are concentrating toward the few top-tier VC firms. Theoretically, it shouldn’t be the case because money is an undifferentiated commodity. Why should you only take money from brand name VCs? Because most founders don’t understand the venture capital business, so they will choose the ones with the best branding and “seem right”.

Of course, there may be some tangible benefits in being invested by prominent VCs. During the roadshow for Meituan’s IPO, a lot of the institutional investors that we were pitching to buy our stocks came from outside of China, so they weren’t familiar with our business. We probably only had half an hour to convince the fund managers who were deciding whether to allocate hundreds of millions of capital. We had a dozen business lines that we could talk about, so it’s impossible for us to explain well we what do and why they should invest in that short period of time. One factor then became important - whether you’re invested by prominent VCs.

How to use Matthew Effect to your benefit?

Let’s use an example to illustrate. When Yahoo! started as a web portal, there were a few other competitors. Yahoo! was trying to raise money from investors at a $2 million valuation in 1994. It was a high valuation at the time for a company started by two college students, and the product was just two web pages, so most investors were hesitant. Sequoia Capital was not and they quickly invested $2 million dollars at double the valuation. Here’s why Sequoia decided to invest:

For most venture firms, an investment has to follow a process that typically takes one to two months. As the Web was just taking off, the difference between competitors was just a matter of weeks. Yahoo! has a two-week lead over competitors. By cutting short our investment process, we can expand their lead to two months. For a nascent industry, two months means a lot.

The two founders were still in college. A $2 million dollar investment in them would attract a lot of eye-balls and media, which would direct traffic to Yahoo!’s site.

When other companies don’t have money but Yahoo! does, plus the halo effect from the fundraising and media coverage, Yahoo! could recruit engineers in the shortest amount of time.

As such, this cycle of activities two months ahead of everyone else would result in media attention and the recruitment of engineers. If done fast enough, when other companies are still in their Series A round, Yahoo would have reached Series B.

(Note: more on the history)

On Product & Business Building

A product may be extremely rough in the early days. That’s fine. When Meituan Delivery just started, there was no technology, it’s just our customer service staff calling the restaurants directly to place orders. We didn’t have a great logo. There are still comments on the Internet saying the previous logo looked like crap (literal). Early product and teams may have many problems, but once Matthew Effect is in effect, many problems would be solved on their own. If you had done everything perfectly, and there are no competitors emerging, it means you’ve chosen the wrong sector.

I asked Today Capital (a top-tier VC firm in China) why they chose to bet on JD.com in 2008, when JD.com was raising a small sum of money but Today Capital gave them a lot more. They said they saw two signals:

JD’s GMV was growing rapidly.

A lot of people on the Internet were complaining about JD.

Despite the criticism, JD was still growing fast. It means the demand was strong, people were complaining about it while still using the product.

For founders, the key is not to have the perfect product, the perfect team, and the perfect investors. The key is to get your product into the positive feedback loops of the Mattew Effect as fast as possible. Remember, most people don’t make choices on perfect information, they just go with the first thing that “seems right”.

Find the article insightful? Please subscribe to receive more content like this and I’d appreciate it if you can leave a comment or help spread the word!